Increasing M&A activities expected in the chemical industry

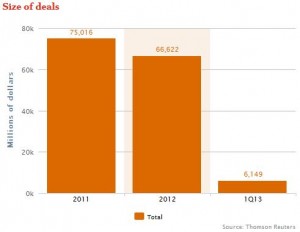

In 2012, mergers and acquisitions (M&A) activity in the chemical industry was low, with a strong decline of deal volumes compared to previous years. Deals in 2012 have been 20% below the 2010/11 levels[1], and in Q1 2013, deal values even dropped substantially lower.

In 2012, mergers and acquisitions (M&A) activity in the chemical industry was low, with a strong decline of deal volumes compared to previous years. Deals in 2012 have been 20% below the 2010/11 levels[1], and in Q1 2013, deal values even dropped substantially lower.

Now, according to consensus view of the world´s leading consultancy firms, M&A activities in the chemical industry are expected to take off.

Best performing chemical subsectors in 2012 were compounding, pharma & agro intermediates, rising by more than 70% in the last 12 months, according to the Valence industry sub-sector stock price analysis[2]. Underperforming performing sectors with a negative performance were fibres, basic chemicals, commodity polymers and pigments.

Biggest deals by volumes in 2012 were mega deals in Specialty Chemicals, including Du Pont Performance Coatings (acquired by Carlyle), Lincare (Linde), Solutia (Eastman Chemicals), Consorcio Comex (Sherwin-Williams). A compilation of largest deals with transaction values of more than 1 bio USD is compiled by PWC[1]. Interestingly, in 2012 the largest deal was close to 5 bio USD, however, in 2011 several large deals even reached close to 10 bio USD.

In Q1 2013, M&A deal activity in chemical industry is actually at the lowest level since the global recession in 2009, according to PWC[3]. This was primarily due to a substantially further drop-off of mega deals (transactions larger than 1 bio USD). Remarkably, in this period, 45% of total deal value was in the US[4].

This low M&A trend is observed not only in the chemical industry, it is experienced in many global industrial products manufacturing industries which “slowed during the first quarter of 2013, as companies stepped back to evaluate their growth strategies amid continued uncertainty related to the global economy, as well as potential impacts of changes to tax and budget policies in the U.S.”, according to a PWC study[5].

“Recently deals have largely been by strategic investors”, says PWC[1], and 91% of transactions valued at 50 mio USD or more during 1st quarter of 2013 were closed by strategic investors[3]. But this picture may change, private equity may be able to operate more aggressively in the future again.

“Financing for private equity remains strong in the US, and Europe has improved from the trough last year…….private equity could soon start to compete more aggressively with strategic buyers” writes Valence Group[2], a consultancy firm specialized at deals in the chemical industry, in their April 2013 newsletter.

Deloitte Touche, in their the recently published 2013 Global chemical industry mergers and acquisitions outlook [6] pointed out “the global chemical industry is experiencing a portfolio realignment putting increased pressure on companies to find new growth markets”

In North America, the outlook is getting more optimistic: “the recovery of the construction market, shale gas availability and lower feedstock prices will likely play a role in increased M&A activity in 2013”, according to Deloitte[6].

Although the economy in Europe is still weak in the context of the Euro debt crisis, nevertheless “in Europe the chemical industry is among the most active sectors pursuing M&A opportunities”. Key drivers of this activity include strong balance sheets of many corporations, continued portfolio realignment, and an increased focus on international investments, especially in emerging markets.

In Europe, there is increasing interest by Chinese and Middle East companies, driven by sovereign wealth, concludes Deloitte[6].

According to PWC[1], advanced economies stillhave contributed a high share of the deals (71% Q4 2012, 62% 2012, 59% 5y average ), and – perhaps surprisingly – had been actually increasing until Q4 2012. But now BRIC targets are expected to rebound.Especially China is now growing significantly in term of M&A deal activities.

A recent news article in Chinadaily.com.cn emphasized the same message, claiming “growth in M&As will continue to be strong in 2013, especially in the manufacturing sector in the European market”[7].

According to KPMG´s senior executives, interviewed by ICIS, “A global chemical merger-acquisition season could soon take off“[8].

[1] PWC: Chemical Compounds –Forth quarter 2012 global chemicals mergers and acquisitions anaylsis:

[2] The Valence Group – Chemicals M&A review, April 2013

[5] First quarter Industrial Products M&A activity slows as companies evaluate outlook

[6] Deloitte Touche 2013 Global Chemical Industry Mergers and Acquisitions Outlook