Finally the digital revolution in textile ink jet printing has started

Globally more than 20 bio meters of textiles are printed. Mainly due to low cost production more than 50% of textile printing is processed in Asia. Rotary screen printing has by far the highest market share, followed by flat bet printing. In textile printing, in recent years there has been special interest in digital printing. However, digital printing is still comparably small with less than 2% market share, substantially less than in other non-textile printing applications.

Globally more than 20 bio meters of textiles are printed. Mainly due to low cost production more than 50% of textile printing is processed in Asia. Rotary screen printing has by far the highest market share, followed by flat bet printing. In textile printing, in recent years there has been special interest in digital printing. However, digital printing is still comparably small with less than 2% market share, substantially less than in other non-textile printing applications.

Why digital printing?

Digital (ink jet) printing combines many advantages: easy coloration, direct printing off the computer screen, no screens, no colour kitchen, and attractive designs – even designs which are not possible with any other printing technique.

In the video, John Scrimshaw, Editor of Digital Textile magazine, debates the rapid growth of digital textile printing, which is being seen particularly in traditional markets, the demanding technical specifications within this sector and the predictions made at the FESPA Digital Textile Conference 2008 in Geneva, Switzerland.

Productivity of ink jet printing

Ink Jet printing technology has been around for many years, but in textile printing the market penetration is limited, the global market share of digitally printed articles is 1-2% only. Why is this ? Traditionally, it has been considered by industry experts as not competitive against rotary screen and flat bed printing. Ink jet printing on textiles has been considered as too slow, too expensive and only suitable for sampling and very short run lengths, or special designs.

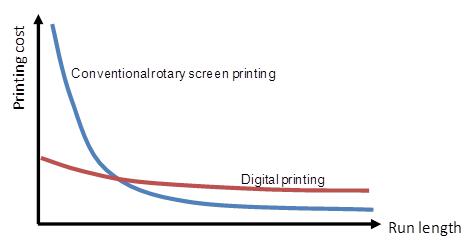

Due to slower speed, ink jet printing on textile fabrics was only economical against rotary screen printing technology at low run lengths. Ink jet printing is generally more favorable at lower run lengths, since there is no need for costly screens when designs are changed, and idle times are reduced substantially.

The break-even point of a particular run length, when ink jet becomes competitive, depends on many parameters such as printer speed, ink prices and screens prices[2].

In the recent 3-4 years, things have changed and ink jet has become much more attractive. And in future, it is expected that the situation will change even further in the favor of digital printing. Firstly, due to fashion cycles and logistics requirements, there is a trend for shorter run lengths, especially in Europe. Over the years, average run lengths have fallen significantly, from an average of globally over 4000 meters to less than 2000 meters[1], in Europe even much lower. Secondly, ink prices are falling rapidly and printer speeds are increasing as well.

The revolution has started

Yet, the perception among many textile producers is still that ink jet is not competitive, considering the above mentioned constraints. However, with latest developments of high speed print heads and digital printers for textile printing this perception may finally change.

The latest generation of textile ink jet printers, for example the LaRio printer of the leading Italian company MS, is claimed to be running at a speed of 7200 m2/h, which means it is at least as productive or more than rotary screen printing. This new generation of machines makes ink jet printing on textiles significantly more competitive.

According to Walter Oggionni, CEO of MS Printing Solutions, the new generation of printers will finally trigger the long expected digital revolution :

“Up until now digital machines were not fast enough to consider replacing analogue rotary. However, since we have introduced LaRio and now both flat and rotary printing can be replaced by digital format, so it is safe to say that someday all printing will be done digital format. MS LaRio was launched during 2012 and it has changed the way of thinking for the textile printing industry worldwide”

Experts can witness the exiting development at every trade fair since the 2011 ITMA exhibition in Barcelona. Most new investments of printers are in digital printing equipment.

One of the limiting factors are still the comparably high prices for digital inks. However, ink prices are rapidly falling. Today, the ink costs are still the dominating cost factor of running cost. For ink jet to become economically more competitive, ink jet prices have to fall down further.

Ecological advantages

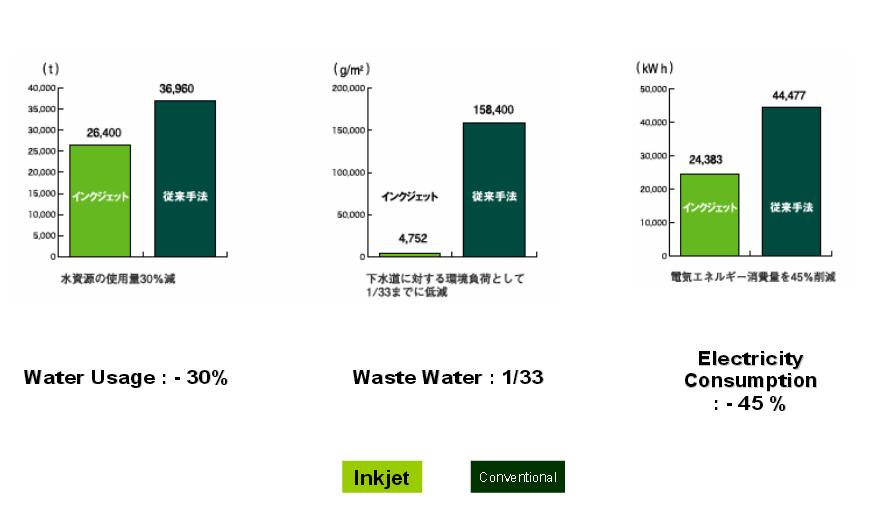

Ink jet (digital) printing has huge ecological advantages: there is no need to manufacture screens and there is hardly any waste: According to Akiyoshi Ohno of Konica-Minolta[2], the leading Japanese technology firm, the waste in ink jet technology is only 1/33 compared to conventional printing, water usage is reduced by 30% and electricity consumption by 45%. Why “hardly any waste”? In conventional printing a printing paste is prepared in a “colour kitchen“, which is not fully consumed. In ink jet printing this is not required.

“Hardly any waste” also means that textile printing could be operated near the designer´s place, in Milano or New York City, instead of a remote production site in China or Bangladesh.

Market development

In Asia, run lengths are still quite large, several thousand meters, and ink jet is still struggling in productivity. However, in Europe, where shorter run lengths of less than 500 m are common, ink jet is nowadays the big thing in the textile industry. Italian fashion goes entirely digital (Miroglio), and Germany´s largest textile printer KBC has switched a significant part of their production to ink jet printing. In an exclusive interview Henri Rowienski, M.D. of the KBC (Manufaktur Koechlin, Baumgartner & Cie.), a leading German women´s fashion manufacturer, confirmed that his firm had installed 16 Reggiani printers after ITMA 2011[3] and shifted a substantial part of production to digital printing.

Can digital printing replace conventional technologies, and how fast?

Can ink jet replace rotary screen printing? The answer is yes, to a certain extent, but not completely, and the big question is how fast.

Can ink jet replace flat-bed printing? The answer is again yes, and short to mid-term it is expected that ink jet would replace flat bed printing at a faster extent than rotary screen printing.

|

|

|

Rotary screen printing |

Flat bed printing |

Considering running cost of printed designs, a partial replacement of rotary screen printing, today by far the most widely established printing technology, is possible. To what extent and how fast this can be achieved depends on many parameters. The price of inks has already been mentioned above.

Ink jet printing allows a variety of designs which are not conceivable by conventional printing technologies. On the other hand, not all designs and fabric qualities can be printed by ink jet which has an inferior through-print compared to rotary screen printing. Also, some designs and techniques such as discharge printed designs are not possible with ink jet printing[4,5].

Ink jet printing allows a variety of designs which are not conceivable by conventional printing technologies. On the other hand, not all designs and fabric qualities can be printed by ink jet which has an inferior through-print compared to rotary screen printing. Also, some designs and techniques such as discharge printed designs are not possible with ink jet printing[4,5].

Moreover, in Asia often the finer fabrics for domestic markets do not properly run in ink jet printing. This means, a full replacement is not possible but even a partial replacement, say 20-30% would be a dramatic increase of market share for ink jet printing from today´s levels.

The speed of this possible replacement is another question. Apart from the above mentioned ink cost issue there is the question of capital expenditure for expensive new generation of ink jet printers. We believe in future a high share of new investments of textile printers will be done in ink jet equipment, especially in the European market. In Asia the speed of ink jet market growth is lower, due to much larger run length of printed articles and because of for mass production. Existing equipment will continued to be used, considering the life-time of a printing range of more than 20 years this is a limiting factor for replacement theories.

Besides, the speed of growth has to be supported by the manufacturers of printers who are often small to mid sized companies. Current market estimates assume a growth rate CAGR (compound annual growth rate) of more than 30%, coming from a market share of 1-2% only. We believe this is even too low and the growth rate of digital printing is eventually determined by production capabilities of print head and printer manufacturers, especially of the technology leading brands. Keeping in mind the global growth of all printed articles is around 2% this would mean that ink jet is hardy able to cover the global growth but that would not include a pro-active substitution scenario of other printing technologies. For a substitution of flat-bed and even rotary screen technologies a much higher growth rate would be required than what is today possible.

Ink jet printers (hardware)

Leading hardware players (print-heads and printers) are Japanese and European, in particular Italian, companies. Japanese suppliers include Konica-Minolta (JP), Epson (JP), Kyocera (JP), Mimaki (JP). European suppliers include Robustelli (IT), Reggiani (IT), MS (IT) and Stork (NL), just to mention a few selected players.

The development in print-head and printer technology is one of the hottest areas in the whole of textile processing equipment and it is exiting to follow how the digital revolution will unfold in the coming years. Especially the latest generation print head by Kyocera has opened the development of very fast digital printers for textiles.

Digital Inks (consumables)

As mentioned above, one of the limiting factors are still the comparably high prices for digital inks which are rapidly falling but still are the dominating cost factor of running cost.

In inks, we are today mostly dealing with reactive dyes (for cotton), disperse dyes (for polyester) and acid dyes (for nylon). There are various chemical players as well as specialised formulators in the market offering digital inks. Also, some hardware companies have their own branded inks and offer a complete and comprehensive package. Digital inks are still expensive – significantly more expensive than dyes and pigments for conventional printing – due to the know-how involved in compositions and specific formulations. The product base of the colorants, however, is mostly the same. In the near future, more competition in the inks is expected, considering the still attractive margins. This will ultimately lead to lower prices – we believe substantially lower – making ink jet solutions more attractive for the textile printers.

It is beyond the scope of this article to discuss in detail the product offers of hardware and consumables suppliers. On request we can discuss more details.

About StepChange Innovations

StepChange Innovations has carried out technical and commercial due diligences of players in digital (ink jet) textile printing. We are a network of textile engineers with long experienced in textile printing markets. We are happy to support upcoming project opportunities. We also offer trainings and webinars on ink jet printing technology.

[1] Philips, T. (Xennia), Textile Coating and laminating Conference, Cannes 2010: Revolutionizing Textile Decoration and Finishing with Digital Inkjet Technology

[2] Akiyoshi Ohno (Konica Minolta), Ink jet textile printing, Amsterdam 2006

[3] Reggiani has sold 16 printing machines after ITMA 2011, indicates strong future of digital printing technology in textiles

[4] Besenreuther,G., Textilveredlung 47 (2012), 11-12

[5] Fibre2fashion: Getting Digital with Textile Printing

Pingback: Textile Printing supplier SPGPrints acquired by Investcorp