Will the textile industry move out of China?

The global textile industry may be at crossroads of change. Low cost based on cheap labour has been the main reason why the textile industry in China has enjoyed an extraordinary growth in the last two decades, and why the textile industry has declined sharply in the traditional markets in Western Europe and the US.

The global textile industry may be at crossroads of change. Low cost based on cheap labour has been the main reason why the textile industry in China has enjoyed an extraordinary growth in the last two decades, and why the textile industry has declined sharply in the traditional markets in Western Europe and the US.

But today China is not the cheapest producer any more. With the average wage of the 23 million textile workers in China reaching $600 a month, garment factory owners are starting to face great pressure as labour costs soar in China[1].

What is the alternative? Relocation to Africa and South East Asian countries, in terms of costs and market access, is proving more and more attractive for companies.

Going Africa ?

Some Chinese textile manufacturers have started moving to Africa.

Xu Zhiming, chairman of Yuemei Group, a leading enterprise in the Chinese textiles industry and one of the largest importer and exporter, is quoted saying “Africa will definitely be the manufacturing center of the world in the future”[1].

Jiangsu Lianfa Textile Company Limited, has committed to build a large textile plant in Kenya. The investment is 500 mio USD. The textile factory will be one of the largest in the African continent and will create more than 30,000 jobs[2].

International retailers have started entering the African continent. Tesco announced to increase textile sourcing from Africa[3] The Swedish H&M is building a factory in Ethiopia[4]. The US company PVH, which produces labels like Calvin Klein and Tommy Hilfiger plans to start production in Kenya[4].

The Turkish garment manufacturer Ayka has also opened a branch in Ethiopia, in which it has invested US$ 160 million. It employs around 7,000 people and plans to scale up to 10,000[4].

Apart from Sub Saharan Africa, North Africa is seen as another important destination. In North Africa there is already a developed textile industry, e.g. in Egypt and Morocco[1].

Other industry leaders such as Hongkong based Esquel, a manufacturer of high-end shirts for international retailers such as Zara, Ralph Lauren, Tommy Hilfiger, Nike and others, do not think China’s textile industry has approached its sunset yet[1]. Instead of retreating from China, Esquel has planned major expansion in central China. The company plans to invest 325 million US$ to build a new factory in Guangxi Zhuang autonomous region.

To judge all these developments, one has to understand the significance of China for the global textile market and the cost structures in the textile industry.

The significance of China for global textiles

According to the WTO statistics database of global trade [5], by 2013 the size of the global textile and clothing exports was 766 bio US$. China holds a commanding market share of 37% (284 bio US$) of global exports. That number alone shows the significance of China and what it means for the global textile business. China is far ahead of all its competitors. The second largest is India with 4.7% share only, far behind China.

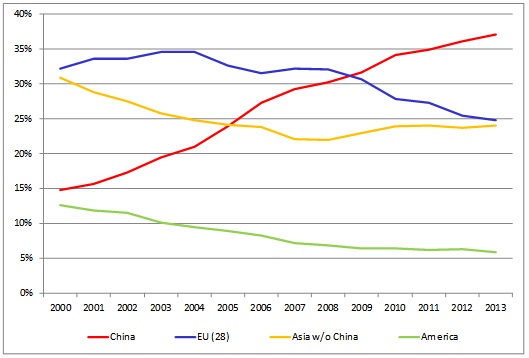

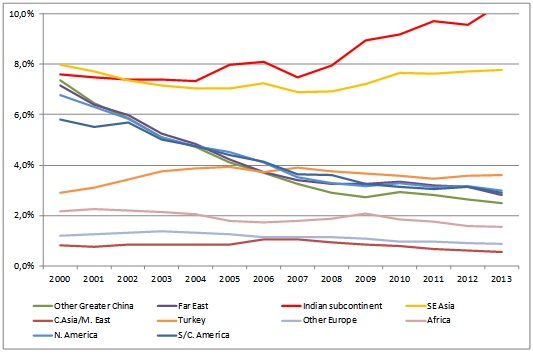

The following charts and the table illustrate share of global exports, absolute trading value in US$ and CAGR% . For CAGR I have used the period 2007-2013 to smoothen the impact from the financial crisis in 2008/09.

Share of global exports for textiles and clothing:

The countries in the Indian subcontinent, mainly India and Bangladesh, have grown considerably as well since 2000, but even combined they only reach a share of 10% .

America (from 12.6% to 5.9%) and Europe (from 32.2% to 24.8%) have declined significantly in the period.

China’s textile industry´s growth has slowed since 2011. From 2000 to 2006, the average growth rate (CAGR) was 18.4%, but it dropped to 8.8% since 200. It still remains almost at double the average global growth rate (see table below)[5].

Considerably higher growth rates have been recorded in Vietnam (16.7% since 2007), Bangladesh (17.3%) and India (10.3%) [5].

Looking at the table, the size of EU-28 may surprise; this is due to internal trade between EU member states. Trade is not production! The trade surplus (exports minus imports) of EU-28 is -70 bio US$ (2013), compared with China 257 bio US$ and USA/ Canada -109 bio USD$.

Besides the exports, the domestic market has to be taken into account as well, if one want to get a feeling for the scale of the textile industry. China´s domestic apparel market is estimated 165 bio US$[6], with a growth of 10% p.a. By 2025, a size of 540 bio US$ is projected[6].

These numbers show very clearly how massive the market in China is and how far ahead it is from all other nations.

But the data also indicate that the momentum is fading, and other emerging countries now grow faster, such as Vietnam and Bangladesh, that have enjoyed double digit growth rates (2007-2013).

Textile and clothing exports in 2013 in mio US$, by countries:

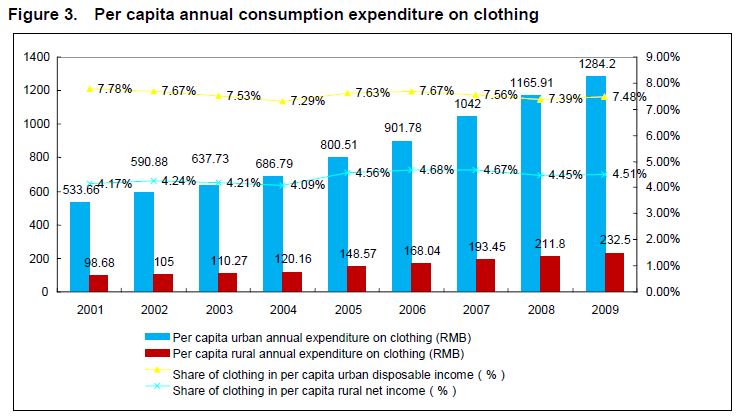

The domestic market in China – Textile consumption per capita

As mentioned, China has a huge domestic market. According to the National Bureau of statistics of China, the growth of retail sales of clothing, textiles, shoes and hats during 2007-2012 was above 20% p.a.

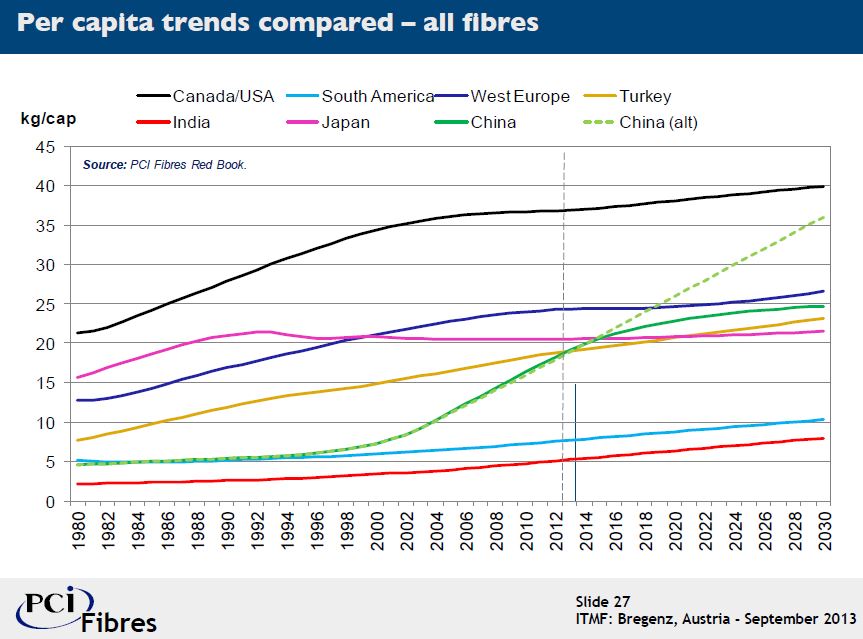

For judging the growth potential of textile markets, the per capita textile consumption in a market is important. In China, the per capita textile consumption is still below the level of Western nations. With increasing buying power this gap will gradually narrow.

The Chinese market for clothing is continuously growing. The per capita expenditure on clothing of urban households has grown by 140% in 2001-2009, with a 7.5% of disposable income spent for clothing[7].

From 2010 to 2015, the per capita apparel consumption is expected to increase by 75% in China, according to Technopak Advisors [8].

According to PCI Fibres, a specialist consultancy firm in fibres and textiles markets, China (18 kg) has already reached in 2012 a level near to South Korea, Taiwan and Japan (each ca. 21 kg). This is still less Western Europe (23 kg) and the USA (35 kg).

If PCI Fibres is correct, and if one extrapolates the trend, China would bypass West Europe by roughly 2018 (as indicated in PCI Fibres charts[9]).

The Chinese growth is seen at 9.5% (2003-13) and 2.5% (2013-20) p.a., although declining but still much larger than the 1.4 % growth rate in West Europe.[10]

It looks surprising that China has already reached high levels, as suggested by PCI Fibres. But if it would, many of the projected growth rates would have to be questioned. Especially extrapolating current growth trends (see chart of PCI Fibres) seems questionable: Why whould Chinese consumption of textiles become much higher than in other Far East nations, such as Japan and South Korea, or even in West Europe?

Labour cost in the textile industry

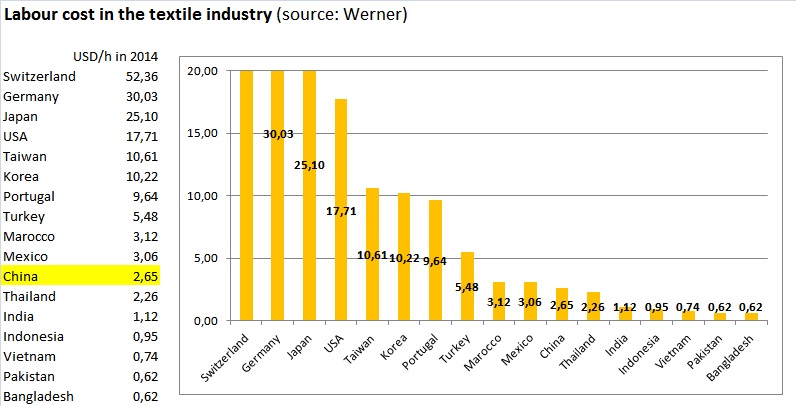

Now let´s look at some hard facts of labour cost in the textile industry world-wide. Cost benchmark data for labour cost in the textile industry are compiled on regular basis by Werner[11]. The data reveal that the lowest labour costs continue to be noted in Asia. Of the important textile manufacturing nations, Bangladesh, Pakistan, Vietnam and Indonesia have lowest cost. India, the second largest textile producer in the world, increased its labour cost from 0.58 US$ in 2000 to 1.12 US$ in 2014, which is clearly at a much lower rate than in China now.

China has faced a continuous increase in labour costs which is now 2.65 USD/h, compared with 2.1 US$ in 2011 and as low as 0.69 US$ in 2000. The minimum wage of textile workers in China is growing 10% every year. And by only offering the minimum wage, one can never recruit a skilled worker. Clearly, these are indications that China is losing its base as cheap low cost production centre of the world. Being cheapest has traditionally been the basis of the China textile manufacturing. Considering the size of the industry, there could be epic changes ahead.

However, the labour cost is still lower compared to other important textile countries such as Turkey (5.48 US$/h), an important producer for the European market, and also lower than Mexico (3.06 US$/h) which is an important producer for the US market.

It may be surprising, but even the North African countries such as Morocoo have slightly higher labour cost (3.12 US$/h).

But with the current growth trend, China´s labour costs are increasing at a faster rate than ever before and will soon bypass these nations and become more expensive in terms of labour.

Besides the surging hourly wages, China has relatively high social welfare compared to the rest of Asia, contributing 35%[12]

But labor cost is just one element of competitiveness. The most critical factor of competitiveness is labor productivity. Here China has advantages compared to most of the other low cost countries. For example, the far better infrastructure, skills and experience of Chinese textile workers will certainly beat many other cheap labour countries.

Cost of textile production

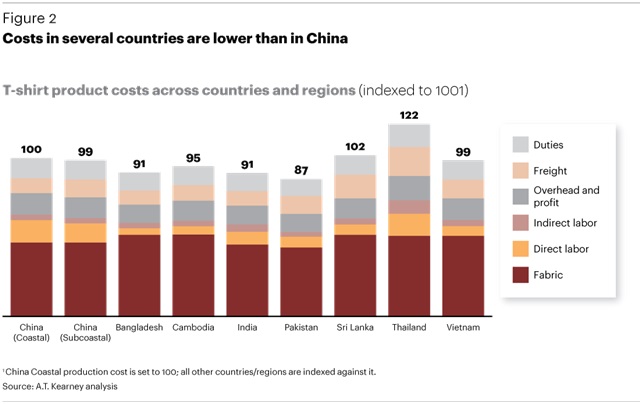

Now let us look at all the cost factors that affect a textile production, for the example a t-shirt production. As the example shows[13], China is now roughly 10% more expensive than countries such Bangladesh, India and Pakistan, mainly due to higher labour cost which accounts for roughly 17% in the case of China. Labour cost is even 35% of the total sourcing cost in China, according to A.T. Kearney [13].

But in the case of the t-shirt production, despite higher labour cost, China is still comparable to countries such as Vietnam (99%), due to other cost such as logistics. India (91%), Bangladesh (91%) and Pakistan (87%) are significantly cheaper.

The largest cost factor is material cost, and that varies from country to country. In the study of A.T. Kearney [13] only the level fabric is shown, which includes the fibre (cotton) and also the cost for dyes and chemicals. Depending on depth of shade and colour this may have a significant share of cost as well. It should be noted that the market has faced very significant fluctuations in the cost of fibres and dyes prices in recent years, overcompensating easily all other cost factors. Cotton was at peak price since 2010/11 and reactive dyes prices increased dramatically in last 2 years, due to short supply of important dyes intermediates. These effects, however, may not be sustainable.

China, India and Pakistan are very important cotton growing countries which helps the production of cotton textiles whereas others have to import cotton. And China and India are by far the largest dyes producing nations.

Conclusion

Based on the labour cost development a move of (cheap) textile manufacturing out of China is anticipated. Considering the huge scale and necessary investments the changes can only be gradual.

The Hong Kong Federation of Industries warned as early as 2011 that some 16,000 Hong Kong owned factories in China were at risk of closure[14]. Of those, it is estimated about 30 percent actually shuttered their doors, largely unreported in the international media. Many moved away to Vietnam or elsewhere[14].

Furthermore, the China-ASEAN Free Trade Agreement in 2010 reduced the import/export duties on 90 percent of all products traded between ASEAN nations and China, and helps the more advanced exporting nations in South East Asia.

However, some years later, the export statistics revealed that China could so far surprisingly maintain its share in global trade. But how long can this last when labour cost in China cost is surging further?

Eventually cheap textiles will partly leave, and China will upgrade their production quality, moving up the value chain. Instead of being limited to purely export-driven manufacturing, further growth may come from the huge growth potential of the domestic China market, too. This can stabilize the market.

However, looking at the per capita textile consumption which has already been reached in China, the extent of this growth potential should be examined carefully.

The big deal about China is its transition from export manufacturing to a consumer-driven society. China’s middle class consumer population is expected to rise from approximately 250 million today to 600 million by 2020.

[1]Wang Chao and Liu Lu(China Daily USA, Jan 2015): Textile industry at the crossroads of change

[2]China weaves billions into Kenyan textile industry

[3]Africa the next textile manufacturing hub

[4]The rediscovery of Africa’s textile industry

[6] Agarwal, P. (Wazir Advisors, 2014): “Role of Indian Textile and Apparel industry in changing global supply-demand scenario”, Texcon 2014

[7] International Trade center: „The Chinese market for Clothing” (2011)

[8] Technopak Advisors (2012): “Global Changes in Clothing Consumption, and their impact on fibre-manufacturer supply chains”

[9] ITMF Bregenz 2013, PCI Fibres presentation, slide 27

[11] Werner Int. Hourly Labor Cost Textile Industry – 2014 US$ Operator Hour

[12]China-ASEAN Wage Comparisons and the 70 Percent Production Capacity Benchmark

[13] A.T. Kearney (2012): „Stop the roller coaster – A smarter approach to apparel sourcing“,http://www.atkearney.de/paper/-/asset_publisher/dVxv4Hz2h8bS/content/stop-the-roller-coaster-in-apparel-sourcing/10192

[14] Hong Kong Exporters May Close 16,000 Factories In China Due To High Costs And Low Demand

Pingback: China versus India: where to source from? | inspectionserviceproviders

Textile companies now have much better trading option for display in textiles fair trade or exhibits. Don’t you think this will generate better textile manufacturing options in the country.