Detox in the textile industry – real progress or Potemkin villages?

Detox is an initiative started by the environmental activist organization Greenpeace to eliminate the discharge of hazardous chemicals from the effluents of textile processing houses by the year 2020. The NGO challenges global fashion brands who source from suppliers that allegedly pollute the environment.

Detox is an initiative started by the environmental activist organization Greenpeace to eliminate the discharge of hazardous chemicals from the effluents of textile processing houses by the year 2020. The NGO challenges global fashion brands who source from suppliers that allegedly pollute the environment.

In part 1 of this article we looked at Greenpeace´s assessment criteria. In part 2 we cast light on the progress of the Detox campaign in the textile industry, specifically at the progress of Detox at the fashion brands who have received credit for good progress in Detox: H&M, Benetton and Zara (Inditex).

The H&M case

The credit is understood in the light of the assessment criteria of Greenpeace. H&M, the fast-fashion clothing brand, looks more advanced than many of his peers, but even in their case a closer analysis shows the slow progress of the Detox campaign in the textile industry, opposite highly ambitious targets, when it comes to real implementation.

The ZDHC group, an organisation established by retailers to address Detox in the textile supply chain, has released a manufacturing restricted substance list (MRSL, latest version 1.1 / 2015). This MRSL contains a list of banned chemicals and allowed formulation limits for chemicals suppliers, such as impurities from manufacturing. This list is finally a substantial progress, although ZDHC still allows C6-PFCs, whose toxic risks are unconfirmed, and common solvents such as toluene and DMF. Both is objected by Greenpeace.

H&M has their own, more progressive version of MRSL. They use stricter limits and include more chemicals which, by the way, we addressed as missing by Greenpeace/ZDHC years ago , for example aniline. H&M allows DMF for polyurethane (a major consumption in the textile & footwear industry). Even H&M´s current MRSL also does not meet (yet) the criteria of zero discharge opposite best available technology, as Greenpeace defined it. It can only be a working tool towards the final target.

In contrast to many others H&M has released their supplier factory lists and progress report of water discharge at their suppliers. This must be acknowledged. The suppliers list shows, for example, that they have far more suppliers in Cambodia compared to Germany and UK. It shows that the bulk of their purchasing comes from countries like China, India and Bangladesh. Unfortunately, transparency does not automatically imply a cleaner production at their suppliers´ textile processing factories.

Following Greenpeace´s assessment, we conclude that the average in the industry is less advanced with respect to Detox compliance. We say this while we have to note that others who do not publish supplier lists and discharge data such a report are either worse in tracking and managing these issues, or have concerns in publishing such data.

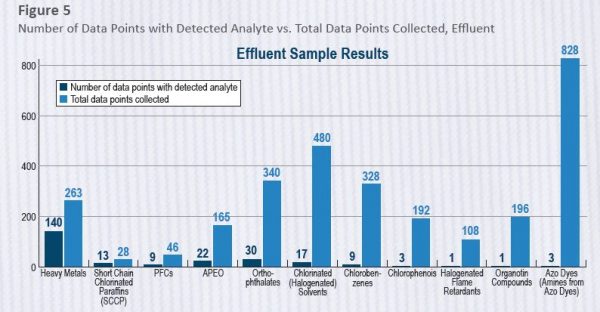

But with all given respect and deserved credit for H&M´s efforts, the charts shown in their 2016 discharge report, obtained from suppliers in Bangladesh (26), China (19), India (6), Cambodia (5), Indonesia (2) and Vietnam (1), is revealing in many aspects:

- The actual progress is, years into the Detox campaign, still showing plenty of unresolved critical issues and no significant improvement over time (according to the timeline from 2012 to 2015). It takes into consideration a tiny fraction of H&M suppliers: The number listed on the website is far higher than the 59 factories shown in the discharge report. For example, for India 6 are included in the discharge report, while 101 suppliers listed as processing factories – a symbol for the diversity and fragmentation of the textile supply chain. We do not know how many of the suppliers are wet processing factories who would be relevant for a discharge report, but it seems even H&M, who is credited a Detox leader in the industry, is scratching on the surface of their supply chain and has not really achieved much of tangible implementation yet. In our understanding a real implementation would require lower discharge of hazardous chemicals and consistent measurement cycles of the same in a relevant dataset of their production volume. A discharge report would have to provide quantitative data of the discharged chemicals and their improvement over time, not only count the factories with incidents. This is missing. We agree that somewhere one has to start and that the process is very complex. However, we should not have the illusion that we have achieved significant milestones of the target.

- Many H&M suppliers have already problems with the quality of the incoming water, especially phthalates, chlorobenzenes, heavy metals and APEOs. Problems with incoming water was reported by ZHDC in their benchmark study 2013 as well. So, the problem already starts when other factories upstream spoil the environment with an effluent discharge of toxic chemicals. Water purification and treatment facilities (investments!) are an issue here, or perhaps the relocation of production to a more suitable place with a better water quality. Or, in the eyes of a buyer, to procure from suppliers who operate in a less polluted location. But clearly, hazardous chemicals in incoming water are no blank check for excluding their relevance. They are in fact very much relevant since traces of hazardous chemicals may even remain in the textiles. The consumer is exposed to this, no matter where the origin is.

- H&M draws an awkward conclusion while stating “analytes were found in both waste water and incoming samples. It implies the origin pollution problem in water source”, judging by the number of occurrences, which is not sound without looking at the concentrations / mass balance of the hazardous compounds. Even if there are hazardous chemicals found in incoming water, it is very much possible that concentrations of the same would have increased during processing when critical chemicals would be applied. As a matter fact, more analytes are found after processing, compared to before, for almost all the chemical classes which were examined (compare red bars with blue bars in Fig.).

- Even APEO, an easy target – because there are readily available alternatives – has not disappeared, despite being on the banned list. APEOs have been banned for use in Europe a long time ago.

- PFC plays a minor role in the case of H&M, and the remaining cases are probably due to incoming water. It should be noted that water repellent products do not play a significant factor in H&Ms fast fashion product range.

- Almost all (!) suppliers listed have issues with heavy metals, 58 of 59 already in the incoming water, which can be due to industrial processes and natural occurrences. This looks far worse than the ZDHC benchmark study of 2013 which reported 53% of heavy metals findings (see Fig. below). It also depends on the definition of “non detectable”. Heavy metals can be measured with great accuracy. Trace amounts of metals in ppm range may depend on natural sources and ubiquitous impurities.

Two other retailers credited by Greenpeace: Inditex and Benetton

The Italian fashion brand Benetton, who also scored well in Greenpeace´s catwalk 2016, claims on their website:

“as of December 2015 published the data referred to the 60 percent of its global Wet Process supply chain. Confirms its efforts to progressively disclose up to 80 percent of the same by 2017.”

Benetton published files of 25 of their Chinese wet-process suppliers uploaded IPE data.

The Spanish fashion company Inditex (brands such as Zara) has a MRSL stricter than ZHDC´s version. For example, they disallow C6-PFCs.

Inditex states on their website that

“1,725 suppliers and 6,298 factories that make up the Inditex supply chain are located in over 50 countries, enabling us to guarantee a wide range of products for the customer. By the same token, near 60% of production is performed by suppliers from areas close to the headquarters and logistical centres in Spain”

In the Detox commitment of Nov. 2012 Inditex confirmed to publish discharge data of at least 100 facilities world-wide by 2013.

Greenpeace usually requested publication on the Chinese website IPE (see below). However, we can´t find many entries in IPE from areas “close to Spain” : Spain (1), Portugal (2), France (0), Marocco (0), Tunisia (0), Egypt (2) and Turkey(16), of which we do not know if they are actual suppliers of Inditex.

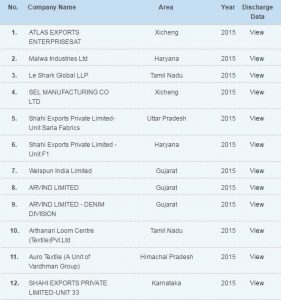

Database with manufacturers discharge data: IPE

The data published in the Chinese website IPE is far from reflecting a representative picture of the brands discharge footprint.

Factory level Detox data can be found here: website IPE.org.cn

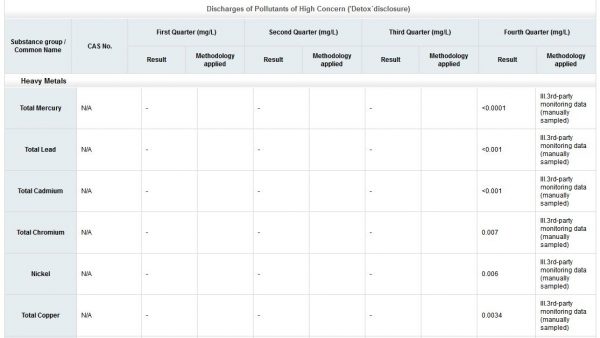

For example, for all of India´s textile processing industry, only 12 (!) factories so far are shown in IPE (2015 data). For all of Turkey, only 16 (!) factories are listed. We know there are far more exporters in India and Turkey who sell to global fashion brands including those who made Detox commitments, and ZHDC members. We remember that H&M alone listed ~ 100 processing factories for India on their website. The IPE data is far from being complete, e.g. in the popular cotton processing region of Tamil Nadu, only 1 company is listed there!

Now, for example, the public can see that processing factory XYZ (example taken from Turkey) has discharged Chromium, Nickel and Copper in respective amounts in mg/L, and so on (see graph). This is how the data looks like:

But the public cannot see which factory is working for which retailer and how much chemicals are discharged related to the individual retailers (typically a non-exclusive 1:n relationship, one factory supplying to n retailers). The information can´t be tracked down to individual brands. It is not possible to judge how much of the discharge is related to H&M, not individually and not in total.

Knowing how some players in this industry are operating, another principal question of concern is the integrity of the data shown in IPE.

Transparency is nice, but who is using the factories discharge data for what purpose? Will Greenpeace have a look at it in the future and consider it, perhaps for a catwalk 2020? This would be nice exercise.

Mid way into the process, although many far reaching commitments have been made, the reality of detox implementation looks like a Potemkin village to mitigate the pressure from Greenpeace.

But discharge of potentially hazardous chemicals is not the only area of concerns these days in retailer-supplier relationships.

Allegations about workers misuse

Just days after earning credit by Greenpeace for their progress in Detox, a news report (“Zara, H&M, Gap Suppliers Abuse Chinese Workers”) about the misuse of Chinese workers came up:

“three of the world’s top fashion labels, Zara (Inditex), H&M and Gap, are supplied from factories which abuse workers’ rights”, according to Hong Kong-based non-government organization Students and Scholars Against Corporate Misbehavior (SACOM) says after investigating factories in China. “Despite the companies’ claims to strong corporate social responsibility (CSR) records, SACOM says its investigation reveals a remarkable disparity between the brands supplier factory CSR policies and the reality in their Chinese supplier factories.” SACOM says the factories force workers to work excessively long overtime to meet disproportionally tight delivery time. “Workers ended up not being paid a living wage.”

The cost of Detox

Although Detox is possible to achieve in many areas, most participants (NGOs, retailers, producers, even chemical suppliers) have not understood at which cost this would be achievable. To implement Detox, many changes of processing dyes and chemicals are required.

There are areas where Detox is achievable when alternatives are readily available.

There are areas where Detox is achievable at a higher cost – in many cases substantially higher cost. Who will absorb this cost increase?

There are areas where Detox is achievable only when compromising on the product quality. Will the consumer accept this?

There are areas where Detox is not achievable with the current technology, with the current definition of Detox – areas where new research is required which may be successful or not.

And there are areas where Detox is not achievable at all, in the strict Detox definition of Greenpeace, due to ubiquitous impurities.

Producers will face cost increases, and the retailer eventually will face higher purchase prices, apart from the internal cost for Detox management. Last but not least, the consumer will decide if he is willing to pay a higher price for detoxed products. The consumer so far has not much taken notice of the Detox campaign, and the trend of fast fashion and cheap, throw-away apparel is just the opposite of sustainability.

Summary

Clearly, the analysis shows that it is a long way to go for Detox 2020. The challenge is high, amidst complexity of the technical and chemical background, fragmented supply chain with hundreds, if not thousands, of suppliers in low labor cost countries with a different education and awareness level. Can this complexity be managed at all? Eventually questions about the current business models of global fashion brands will have to be addressed.

In future articles we will cast some light on selected areas what chemical replacements would imply for product qualities and manufacturing cost.