CRAMS Outsourcing – Political and macro-economical implications

Outsourcing Contract research and manufacturing services (CRAMS) in the pharmaceutical, bio-technological and chemical industry is massive, a multi-billion dollar business. We will outline in this article how big is this business, what drives this business and what are the implications for enterprises and for the society ?

Political and macro-economical implications of outsourcing

But first let us look at outsourcing in general. Offshore “outsourcing is a problem for the US and the first world in general, because all tradable goods production and service jobs can be outsourced“, according to a McKinsey study[i], in the years 2003-2008 the number of jobs outsourced in service sectors would as by their forecast grow from 18 mio to 160 mio. It is a massive trend, affecting a segment of the workforce that was never in history subject to this kind of competition, thereof engineering most drastically affected with 55% „occupations amenable for remote locations“.

But first let us look at outsourcing in general. Offshore “outsourcing is a problem for the US and the first world in general, because all tradable goods production and service jobs can be outsourced“, according to a McKinsey study[i], in the years 2003-2008 the number of jobs outsourced in service sectors would as by their forecast grow from 18 mio to 160 mio. It is a massive trend, affecting a segment of the workforce that was never in history subject to this kind of competition, thereof engineering most drastically affected with 55% „occupations amenable for remote locations“.

The global market for outsourcing services is seen almost 400 bio USD with a long-term growth of 6%, thereof 240 bio USD in IT services being by far the biggest sector[ii] (Gartner, 2012).

In the IT industry, the offshored IT outsourcing services is moving in the US mostly predominantly towards India, and in Europe towards East Europe. In 2011 alone, the US has outsourced 2.2 mio jobs, of which 53% is manufacturing, 43% IT and 38% R&D[iii].

In the ranking of attractiveness of countries by factors such as business attractiveness, people skills and business environment India ranks first, China second, UK 16th and USA 18th (A.T. Kearney study, 2011)[iv].

„What gets outsourced will be the easy to define business processes that in time will become commodities. What will remain will be value added processes that are not easily defined, involve personal relationships or special knowledge“, says Deloitte Consulting chief economist, Carl Steidtmann [v].

What many people may shock is the increasing number of highly qualified jobs such as software development or R&D jobs which are being outsourced, in addition to lower qualified „call center“ jobs and only factory worker blue collar jobs.

Another McKinsey study[vi] „Outsourcing is shaping the global economy – but not everyone is a winner” compares quantitatively the effects from offshoring and came to the interesting conclusion that Germany is losing 0,20 € per 1 € corporate spending in offshoring, while the US gains 1.12-1.14 $ for every 1 $ spent. Main reason are in the macroeconomic perspective less direct benefits retained in the country (savings for customers/investors, transfer of profits, imports of goods), and less value from re-employed labor due to high bureaucracy and the inability to flexibly hire/fire workers for legal reasons. In other words, In the US outsourcing is much easier. Companies can easily fire people without big severance cost, as compared to Germany. Now we have the explanation why the US has lost so many more jobs due to offshore outsourcing, and why German enterprises act much more carefully. In the 2008/2009 crisis most German companies kept their workforce on shorter working hours, partially subsidized by the government.

In the United States even government jobs have been outsourced, e.g. the South Carolina unemployment tax software system or New Jersey unemployment assistance call center[vii].

The political debate is hot. The issue has meanwhile captured attention in the US presidential campaign of 2012, “Mitt Romney’s financial company, Bain Capital, invested in a series of firms that specialized in relocating jobs done by American workers to new facilities in low-wage countries like China and India. During the nearly 15 years that Romney was actively involved in running Bain, a private equity firm that he founded, it owned companies that were pioneers in the practice of shipping work from the United States to overseas call centers and factories making computer components”, reported The Washington Post on June 22, 2012[viii].

The political debate is hot. The issue has meanwhile captured attention in the US presidential campaign of 2012, “Mitt Romney’s financial company, Bain Capital, invested in a series of firms that specialized in relocating jobs done by American workers to new facilities in low-wage countries like China and India. During the nearly 15 years that Romney was actively involved in running Bain, a private equity firm that he founded, it owned companies that were pioneers in the practice of shipping work from the United States to overseas call centers and factories making computer components”, reported The Washington Post on June 22, 2012[viii].

Economists notoriously have claimed that cost savings, new revenues, repatriated earnings and redeployed labor bottom line create more value for the economy and more jobs – if the economy is flexible such as in the US: In the US service sector 10 mio. p.a. jobs are lost due to outsourcing, but 12 mio new jobs are gained elsewhere. Yet one may wonder about the quality of these jobs also. Bluntly speaking, how does it help the society if 10 engineers are replaced by 12 hamburger helpers ? Is the US economy bottom-line more effective than Germany ? Not quite. Well, trade balance sheets and unemployment rates in the post financial crisis era now tell just the opposite story on a macro-economical scale. It should be mentioned also that most of the top consultancy firm studies had been made before the 2008/2009 great depression, and since then they have become more silent on the issue.

Surely the US labor market is more flexible but what matters is also the ability to innovate and manufacture high quality products needed by the market. This requires the attraction and long-term retention of key talent and special expertise. The US hire and fire mentality is not always helpful in this respect. In many ways the US has lost touch.

The development is inevitable macro-economically as well as for each business. Government protectionism would only make the situation worse because it would delay necessary structural changes. “The best way to destroy jobs is for government to try and protect them…… the best way to create new jobs is to allow for their destruction. How much better off would be the US today if we had saved all of those farm jobs a century ago”, says Deloitte chief economist Carl Steidtmann.5

Protectionism is no alternative, eventually it would harm to risk losing everybody´s job. If businesses fail to adjust to market demands which is to provide cost effective products and services, customers will go elsewhere in this competitive market.

As a result of offshore outsourcing, cost of businesses go own, productivity increases, and the consumer appreciates to buy cheaper imported products. Especially the US consumer likes to buy t-shirts for 5$ instead of 50$, or DVD players for 80$ instead of 800$. And in the emerging markets new service jobs are created which helps to fill the gaps between the rich and the poor nations.

But even Mr Steidtmann admits5 “not everyone wins from free trade. Certainly a small group of high cost workers….lose out in the short run”, suggesting it is bad luck if you are the factory worker, and further he concludes “the case for job retraining can be made”.

The only answer to this challenge is: Flexibility to ever changing environments, ongoing process optimizations, and moreover the ability to innovate and differentiate.

Performance of Education Systems

The crucial difference in the long-term is education. Education eventually leads to innovation, better products and services as demanded by the market. Only innovative entrepreneurs will foster this innovation leading to these products and services. It is the job of the governments to provide a platform for world-class education.

Unfortunately, not all the Western countries are performing well when comparing education systems worldwide.

In a recent study of ranking the world´s higher education systems the US universities surprisingly still ranked highest[ix]. The study was based on resources, environment, connectivity and output. This results was mainly due to the highest output measured by the number of publications and their impact, in all other aspects the US was not ranked first. We could challenge the methodology of the study but this would be beyond the scope of this article.

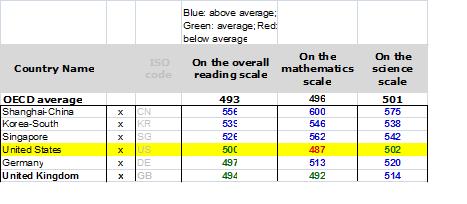

But let us instead look at the PISA study of 2010[x] for education rankings in reading, mathematics and science. Here the data clearly tell quite a different story. In PISA the United States and even Germany rank far behind countries like China-Shanghai, South Korea, Singapore, with especially low rankings (below average of 64 countries survey world-wide) for the US in regard to mathematical and science skills. This is extremely alarming since these skills are crucially required for the generation of innovation.

The fact is also that for example in India, 870.000 IT graduates graduate every year, plus 16 millions others with engineering diploma[xi]. On the other hand, in the UK, 1 out of 5 workers at risk from outsourcing have difficulties in reading and writing11. How to retrain these people for other jobs is the challenge. It is, in the first place, an education challenge.

To conclude the education story, we believe it is even the bigger tragedy that a majority of the most intelligent people in a generation want to become investment bankers and lawyers rather than scientists and engineers, because of absurd financial incentive systems.

The 300 bio USD trade deficit with China[xii] speaks for itself. This is despite epic success stories such the i-phone and i-pad and world leading biotech companies, but so far there wasn´t simply enough of it, and the education system is not any longer meeting the world´s benchmark for excellence. Politics has to act urgently, and the solution is not protectionism. The solution is education excellence.

In the next article of this series (Part II.) of this article series we will look more specifically into the market of CRO outsourcing in the pharmaceutical industry.

[i] McKinsey & Company: „The emerging global labor market. Part I. – The demand for offshore talent in Services“,2005. surveyed sectors : software, IT services, banking, insurance, pharma, auto, helath care, retail

[iii] Job Outsourcing Statistics http://www.statisticbrain.com/outsourcing-statistics-by-country/

[iv] Outsourcing statistics http://outsourcingdefined.com/outsourcing-statistics/

[v] Steidtmann, C. Deloitte Consulting (Chief economits), „The macro-economic case for outsourcing“, Deloitte Research Economic Brief, 2003

[vi] Farrel,D., McKinsey & Company, „Can Germany win from offshoring“, June 2004, http://www.mckinseyquarterly.com/How_Germany_can_win_from_offshoring_1496

[vii] Moore, A., Privatization Watch, Focus on offshore outsourcing, 28 (2004), 12 „Can America learn to love outsourcing – when government jobs go overseas“

[viii] Washington Post, http://www.washingtonpost.com/business/economy/romneys-bain-capital-invested-in-companies-that-moved-jobs-overseas/2012/06/21/gJQAsD9ptV_story.html

[ix] U21 Ranking of national higher education systems, University of Melbourne, 2012

[x] Guardian, http://www.guardian.co.uk/news/datablog/2010/dec/07/world-education-rankings-maths-science-reading

[xi] The future of outsourcing – the impact on jobs http://www.globalchange.com/outsourcing.htm

[xii] US census, http://www.census.gov/foreign-trade/balance/c5700.html